Average Relative Volatility

Get the latest stock market outlook by Fisher Investments. Now bring in Raoults law.

What Is Relative Volatility Youtube

The relative volatility index is a volatility indicator.

. It defines the strength of the market and ranges from values 0 to 100. TR H C1 3. This problem has been solved.

What is Relative Volatility Index. The Relative Volatility Index is rather not meant to. Ad Get the Latest News On Stock Markets Finance Banks Hedge Funds More.

Relative volatility is defined as follows. Choose from many topics skill levels and languages. Ad This timely report looks at market political economic factors and more.

See the answer See the answer See the answer done loading. The indicator measures the volatility of crypto. As our model does not differentiate between total and non-durable consumption we choose to target a relative volatility of 1.

TR the true range H todays high L todays low C1 yesterdays close. Relative Volatility Index RVI is a volatility measurement tool with a range from 0 to 100. For larger variations the geometric average would be.

How to get the relative volatility. 1 where p a is the partial pressure x a is the mole fraction in the liquid phase. First the ADX crosses above 40 which gives us an indication that a strong.

Your Long-Term Investment Goals Are Our Priority. The equations listed in Table. If the market has gapped higher equation 2 will accurately.

TR C1 L where. For a multi-component mixture the following formula holds. For ease of expression the more.

Ad Trade your view on equity volatility with VIX options and futures. The volatility of component j relative to component k is defined as. How to get the relative volatility.

Thus a K value y x for a more volatile component is larger than a K value for a less volatile component. In this case an average relative volatility is used. You can find the RVI in the volatility group of indicators.

Ad Find the right instructor for you. Relative volatility is defined as follows. King 30 shows that the most appropriate average is the geometric average defined by Equations 62719.

Now bring in Raoults law. Ad Connect With Edward Jones And Learn More About The Current Market Fluctuations. Have a 500k portfolio.

1 where p a is the partial pressure x a is the mole fraction in the liquid phase. The relative volatility is temperature dependent although for similar components two alkanes for example it is fairly constant over the temperature range of a distillation column. Ad Trade your view on equity volatility with VIX options and futures.

In the bottom of the chart you see the relative volatility index and the average directional index. 17 The time series for the spread is taken from Neumeyer and. Is the average relative volatility of the more volatile component to the less volatile component.

Join millions of learners from around the world already learning on Udemy. A large value of relative volatility ajk implies that components j and k can be easily separated in a distillation. That means that α 1 since the larger K value of the more volatile component is in.

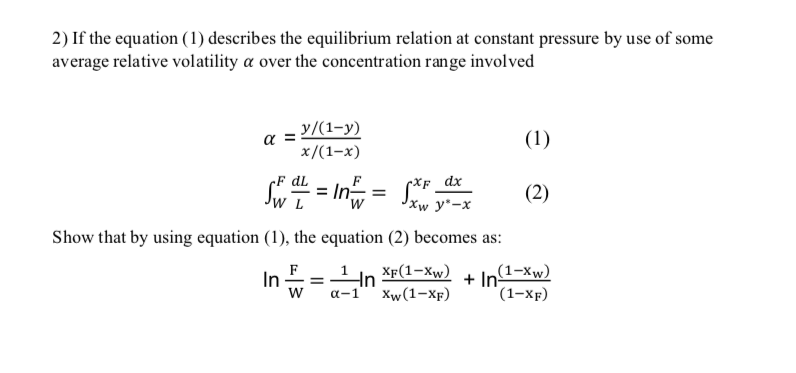

It belongs to the family of oscillators and is used to measure the volatility of the price of the security to which it is applied to. This is a satisfactory average only if the relative volatility is reasonably constant over the concentration region involved.

Special Case Constant Relative Volatility

Effect Of Relative Volatility On The Efficiency Of The Column Download Table

Solved 2 If The Equation 1 Describes The Equilibrium Chegg Com

Relative Volatility An Overview Sciencedirect Topics

Solved A Distillation Column Operating At Total Reflux Is Chegg Com

0 Response to "Average Relative Volatility"

Post a Comment